SOFR 1 Month Term+

8.5% Prime Rate

4.456%

5 Year

Treasury: 4.683% ▼Spread: 0.000%Swap: 4.358% ▼

7 Year

Treasury: 4.663% ▼Spread: 0.000%Swap: 4.296% ▼

10 Year

Treasury: 4.776% ▼Spread: 0.000%Swap: 4.023% ▼

30 Year

Treasury: 0.000%-Spread: 0.000%Swap: 4.687% ▼

Ladder Capital Corp (NYSE: LADR) is an internally-managed commercial real estate investment trust with $5.3 billion of assets as of 03/31/24. Our investment objective is to preserve and protect shareholder capital while producing attractive risk-adjusted returns. As one of the nation’s leading commercial real estate capital providers, we specialize in underwriting commercial real estate and offering flexible capital solutions within a sophisticated platform.

Our investment activities include:

×

Prior to forming Ladder, Mr. Harris served as a Senior Partner and Head of Global Commercial Real Estate at Dillon Read Capital Management, a wholly owned subsidiary of UBS, and previously as Head of Global Commercial Real Estate at UBS and a Member of the Board of UBS Investment Bank, as well as Head of Commercial Mortgage Trading at Credit Suisse. Mr. Harris received a B.S. and an M.B.A. from The State University of New York at Albany.

×

Prior to forming Ladder, Ms. McCormack served as Head of Transaction Management – Global Commercial Real Estate at UBS / Dillon Read Capital Management. Ms. McCormack received a B.A., cum laude, from the State University of New York at Stony Brook and a J.D. from St. John’s University School of Law.

×

Prior to joining Ladder, Mr. Miceli served as a Managing Director in the accounting and finance group of Colony Capital, Inc., and previously as Deputy Chief Financial Officer of NorthStar Asset Management Group. Mr. Miceli is a Certified Public Accountant (inactive) and received a B.S. from the University of Delaware.

×

Prior to forming Ladder, Mr. Perelman served as a Director and Head of Asset Management at UBS/Dillon Read Capital Management. Mr. Perelman received a B.S. from Syracuse University and a J.D. from Fordham University School of Law.

×

Prior to joining Ladder, Ms. Porcella served as a Member of the Global Commercial Real Estate group at UBS/Dillon Read Capital Management. Ms. Porcella received a B.S., summa cum laude, from The Peter J. Tobin College of Business at St. John’s University and a J.D., magna cum laude, from St. John’s University School of Law.

×

Prior to joining Ladder, Mr. Robertson served as Manager and Real Estate Consultant at Deloitte Financial Advisory Services. Mr. Robertson received a B.A. from the College of Arts and Sciences at the University of Virginia.

×

Prior to joining Ladder, Mr. Peterson served as a Managing Director and Co-Head of CMBS Capital Markets at Eurohypo, and previously as an Executive Director at UBS/Dillon Read Capital Management. Mr. Peterson received a B.A. and a Ph.D. in Computer Science from the City University of New York.

×

Prior to joining Ladder, Ms. Wallach served as the Deputy Chief Compliance Officer and Director of Operational Risk Management at Reservoir Capital Group, L.L.C., and previously as an Executive Director at Morgan Stanley & Co. Incorporated. Ms. Wallach received a B.A. with Honors, magna cum laude, from Brown University, and a J.D. from New York University Law School.

×

Prior to joining Ladder, Mr. Cafaro served as Founder and Chief Customer Officer at Alphaserve Technologies. Mr. Cafaro received a B.S., cum laude, from Montclair State University and is an alumnus of Harvard Business School.

×

Prior to joining Ladder, Mr. Esposito served as Senior Vice President, Corporate Controller for both iStar Inc. and Safehold Inc. Mr. Esposito is a Certified Public Accountant and received a B.S. in Accounting from the State University of New York at Albany and a M.S. in Real Estate from the Schack Institute of Real Estate at New York University.

×

Prior to joining Ladder, Mr. Merkur served as an Associate at Tri-Artisan Capital Partners, and previously as an Investment Banking Analyst at Merrill Lynch & Co. Mr. Merkur received a B.S., magna cum laude, from Cornell University.

×

Prior to joining Ladder in 2013, Ms. Tannure served as an Audit Manager at Deloitte & Touche, LLP. Ms. Tannure received a B.B.A., cum laude, from Siena College and is a Certified Public Accountant licensed in New York and Connecticut.

×

Alan H. Fishman is Chairman of the Board of Directors of Ladder Capital. Mr. Fishman has had an extensive career in the financial services industry having served in top executive positions at Washington Mutual Inc., Independence Community Bank, Sovereign Bancorp. and ContiFinancial Corp., and as the Chairman of Meridian Capital Group. Mr. Fishman has been a private equity investor focusing on financial services at Neuberger and Berman, Adler & Shaykin and at his own firm, Columbia Financial Partners LP, and held a variety of senior executive positions at Chemical Bank and American International Group. Mr. Fishman is a member of the board of directors of Santander Holdings USA, Inc. and is the lead independent director, chairman of the Audit Committee and a member of the Executive and Risk Committees of its subsidiary, Santander Bank, N.A. Mr. Fishman is also Chairman Emeritus of the Board of Trustees of the Brooklyn Academy of Music, and Chairman of the Brooklyn Community Foundation. Mr. Fishman is on the audit committee at Continental Grain Company, on the board of MDSolarSciences as well as the boards of several other not-for-profit and civic organizations. Mr. Fishman received a B.S. from Brown University and a Masters in Economics from Columbia University.

×

Brian Harris is a founder and the Chief Executive Officer of Ladder Capital. Before forming Ladder Capital in October 2008, Mr. Harris served as a Head of Global Commercial Real Estate at Dillon Read Capital Management, a wholly owned subsidiary of UBS. Before joining Dillon Read, Mr. Harris served as Head of Global Commercial Real Estate at UBS, managing UBS’ proprietary commercial real estate activities globally. Mr. Harris also served as a Member of the Board of Directors of UBS Investment Bank. Prior to joining UBS, Mr. Harris served as Head of Commercial Mortgage Trading at Credit Suisse and previously worked in the real estate groups at Lehman Brothers, Salomon Brothers, Smith Barney and Daiwa Securities. Mr. Harris received a B.S. and an M.B.A. from The State University of New York at Albany.

×

Pamela McCormack is a Founder and the President of Ladder Capital. Before forming Ladder Capital in October 2008, Ms. McCormack served as Head/Co-Head of Transaction Management – Global Commercial Real Estate at both Dillon Read Capital Management and UBS Investment Bank, managing teams responsible for the structuring, negotiation and closing of all real estate investments globally. Prior to joining UBS, Ms. McCormack was Vice President and Counsel at Credit Suisse and as an associate as leading global law firms. Ms. McCormack received a B.A. from the State University of New York at Stony Brook and a J.D. from St. John’s University School of Law, and currently serves on the Advisory Board of St. John’s Mattone Family Institute for Real Estate Law.

×

Mark Alexander is Head of Technology and Operations at Rockefeller Capital Management, a privately-owned financial services firm offering global family office, asset management and strategic advisory services to ultra-high-net-worth individuals, families and institutions. Prior to joining Rockefeller, Mr. Alexander was the Chief Executive Officer of iCreditWorks, a FinTech start-up that leverages mobile and emerging technologies to transform point-of-care lending between healthcare consumers and professionals. Mr. Alexander has spent his career focusing on financial services, technology and operations, previously serving as an Executive Advisor to McKinsey & Company, Aquiline Capital Partners, and Broadridge Financial Solutions, as well as other advisory services through his company, Latigo Financial Services. Prior to forming Latigo, Mr. Alexander spent 24 years at Merrill Lynch and its successor Bank of America Merrill Lynch, becoming the Chief Information Officer and Head of Technology and Operations for Global Markets and Global Wealth and Investment Management. Mr. Alexander is a Certified Public Accountant (inactive) and received a B.B.A. from Hofstra University and an M.B.A. from New York University’s Stern School of Business.

×

Douglas Durst is the chairman and a member of the third generation to lead The Durst Organization, one of the oldest family-run commercial and residential real estate companies in New York City. Mr. Durst joined the Durst Organization in 1968, learning the business from his father, Seymour, and two uncles, Roy and David. Under the leadership of Douglas and his cousin Jody, The Durst Organization built the nation’s first sustainable skyscraper, 151 West 42nd Street (formerly 4 Times Square), and the first LEED Platinum high-rise office tower, The Bank of America Tower at One Bryant Park. Today, the company owns, manages and operates a 13 million square foot office portfolio and nearly 3,500 residential rental units, as well as overseeing the development, management and leasing of One World Trade Center. Douglas is the chairman of the Real Estate Board of New York and he serves as a director of The New School, The Roundabout Theater and Primary Stages. Mr. Durst also serves as a Board member of the Earth Day Initiative. Mr. Durst received a B.A. from the University of California Berkeley and a Doctor of Humane Letters (honoris causa) from each of the City University of New York and Allegheny College.

×

Jeffrey B. Steiner is a Partner at McDermott Will & Emery LLP, an international law firm, and has more than 35 years of experience in real estate, real estate finance and real estate capital markets transactions. Mr. Steiner formerly served as the Global Head of the Real Estate Finance Group of McDermott Will & Emery, the co-managing partner of the firm's New York office and a member of the firm’s Management Committee. Prior to joining McDermott Will & Emery, Mr. Steiner was a Partner at DLA Piper LLP (US), where he was the Global Co-Chairman of the Finance Department and a member of the firm’s Executive Committee. Mr. Steiner received a B.A. from McGill University and a J.D. from Fordham University School of Law.

×

David Weiner, Senior Vice President/Investments at Stifel, has over 30 years of investment industry experience. Prior to Stifel, Mr. Weiner created and managed Chrome Capital Management, LLC, a registered investment advisor and, prior to founding Chrome, served as a Managing Director at RBC Capital Markets, where he ran the equity swap desk and marketed equity derivatives to RBC’s corporate clients. Mr. Weiner has held various equity and fixed income derivative and capital market positions at CALFP, UBS, Deutsche Bank, and Lehman Brothers. He received a B.S. from the State University of New York at Albany.

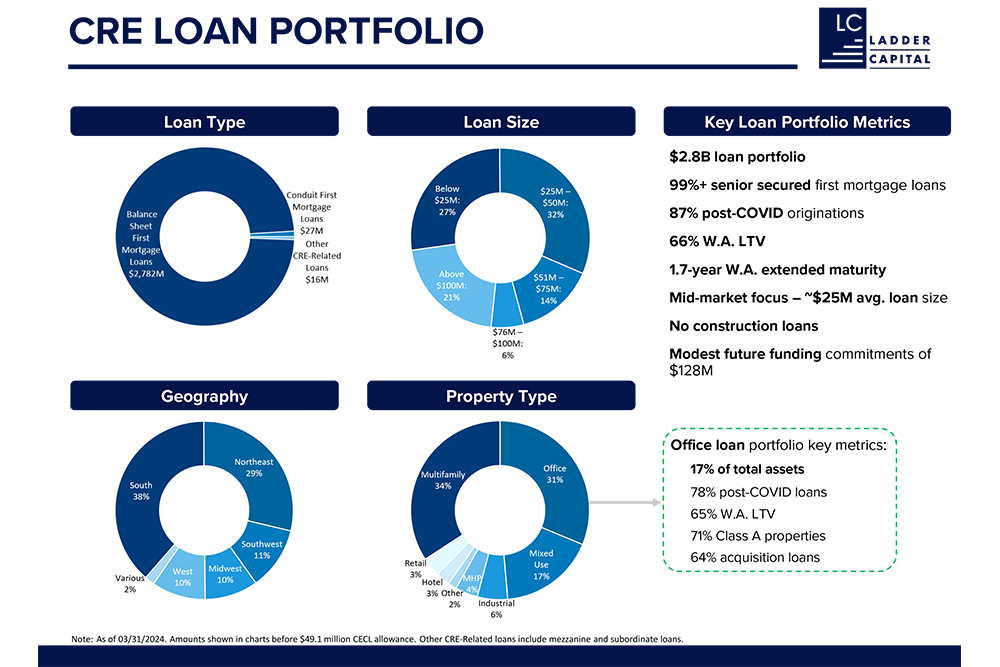

Ladder Capital Corp (NYSE: LADR) is an internally-managed commercial real estate investment trust with $5.3 billion of assets as of 03/31/24. Our investment objective is to preserve and protect shareholder capital while producing attractive risk-adjusted returns.

Our goal is to be at the heart of the financial services industry as businesses expand across.

Far far away, behind the word mountains, far from the countries Vokalia and Consonantia, there live the blind texts. Separated they live in Bookmarksgrove right at the coast of the Semantics, a large language ocean. A small river named Duden flows by their place.

One morning, when Gregor Samsa woke from troubled dreams, he found himself transformed in his bed into a horrible vermin. He lay on his armour-like back, and if he lifted his head a little he could see his brown belly, slightly domed and divided by arches.

$25 Million

Average Loan Size

Originated Loans in Over 475 Cities Across 48 States

$17.3 Billion

of Total Loans Securitized or Sold

Top CMBS

Loan Contributor

$5.3 Billion

in Total Assets

Please fill out the form and press the submit button.

We will get back to you with 1-2 business days.

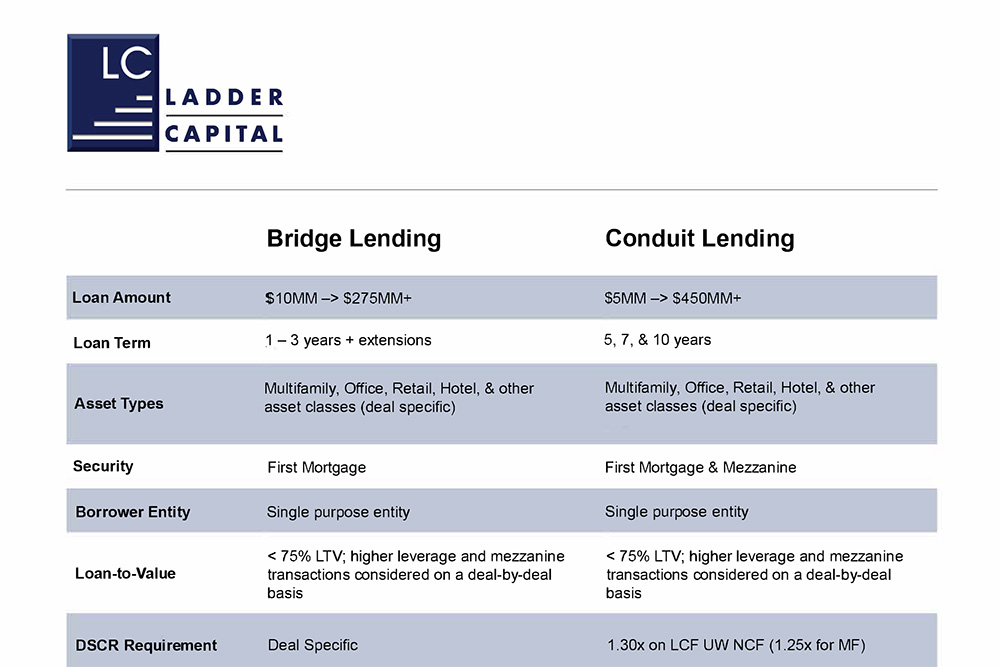

Ladder Capital (NYSE: LADR) provides fixed-rate and floating-rate commercial mortgages, mezzanine financing and preferred and direct equity to partners.

As of October 21, 2019

* This data is provided by a third party for reference purposes only.

Ladder Capital does not guarantee its accuracy.

** Treasury rates, swap spreads and stock price are delayed 20

minutes. ©theFinancials.com

*** Mid-point of bid/ask range shown for rates and spreads.

+ SOFR 1 Month Term rate is updated once on a daily basis. This market data is the property of Chicago Mercantile Exchange Inc. or it’s licensors as applicable. All rights reserved, or otherwise licensed by Chicago Mercantile Exchange Inc.

| Treasury | Spread | Swap | |

|---|---|---|---|

| 5 Year | 1.466% ▲ | 0.004% | 1.470% ▲ |

| 7 Year | 1.560% ▲ | -0.060% | 1.500% ▲ |

| 10 Year | 1.649% ▲ | -0.059% | 1.590% ▲ |

| 30 Year | 2.144% ▲ | -0.374% | 1.770% ▲ |