SOFR 1 Month Term+

3.7339% Prime Rate

6.75%

5 Year

Treasury: 3.695% ▲Spread: 0.000%Swap: 3.430% ▲

7 Year

Treasury: 3.908% ▲Spread: 0.000%Swap: 3.570% ▲

10 Year

Treasury: 4.149% ▲Spread: 0.000%Swap: 3.765% ▲

30 Year

Treasury: 4.827% ▲Spread: 0.000%Swap: 4.132% ▲

Who We Are

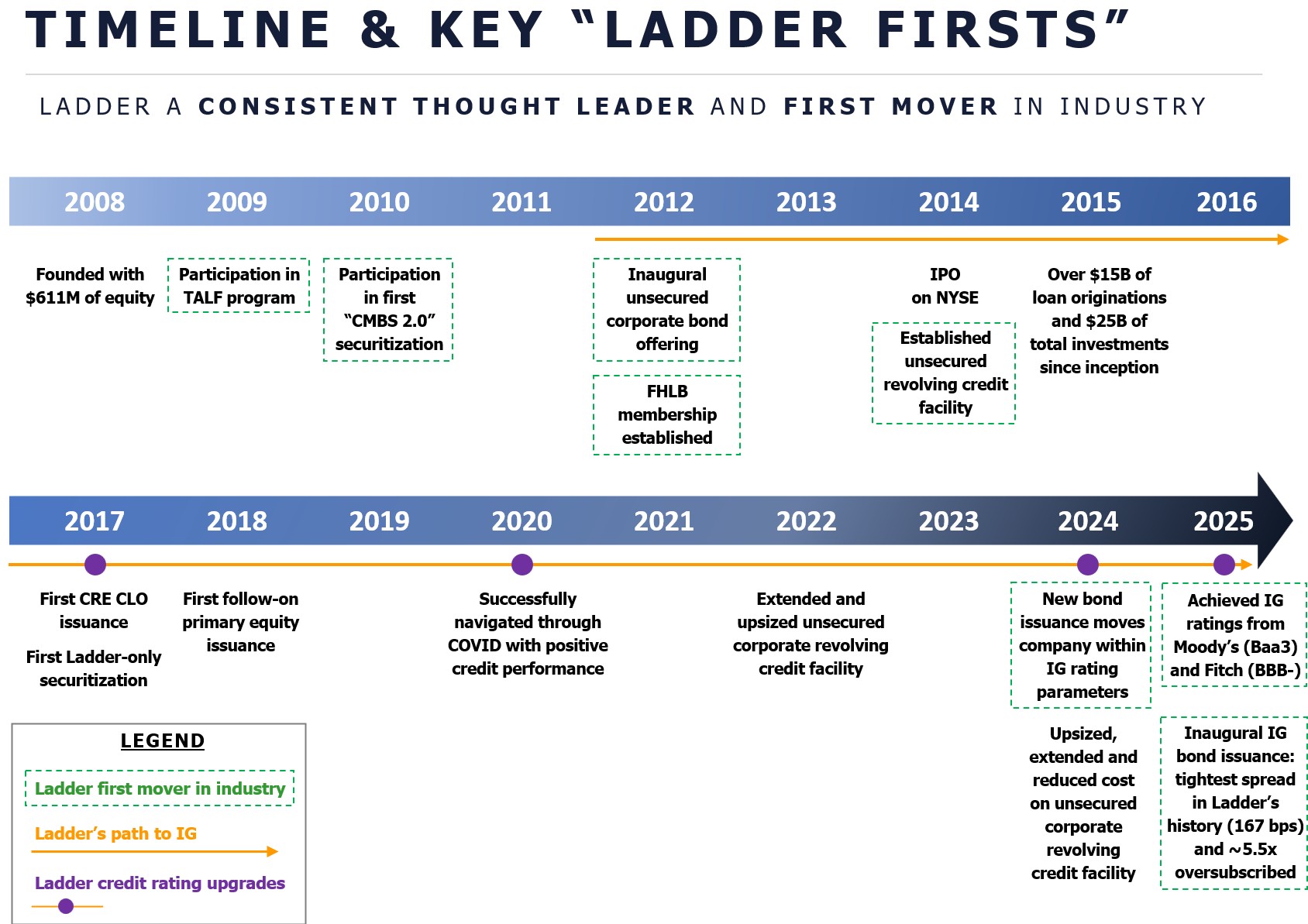

Ladder Capital Corp (NYSE: LADR) is a leading, investment grade-rated commercial real estate finance company. We specialize in delivering flexible capital solutions across the commercial real estate landscape, particularly focusing on the middle market. Our investment objective is to preserve and protect shareholder capital while generating attractive risk-adjusted returns.

What We Do

We specialize in underwriting commercial real estate across the capital stack. Since our founding in 2008, we’ve invested over $49 billion—supporting both institutional and middle-market clients nationwide. Our core business centers on originating fixed and floating rate first mortgage loans across all commercial property types.

We also:

How We Are Different

Our decision-makers are in the room, and the capital is under our control.

As the only permanently capitalized commercial mortgage REIT with true autonomy from third-party secured financing and securitization exits, we can act swiftly and decisively to meet clients’ unique needs and deliver unmatched certainty of execution.

Our leaders are personally invested in our success—literally.

We’re internally managed and led by a seasoned management team with deep industry expertise. With over 11% insider ownership, the interests of our management team and board of directors are strongly aligned with those of our stakeholders.

Long-term relationships drive our success—and yours.

We pride ourselves on being a flexible and dependable capital partner, fostering long-term relationships, repeat business, and strong brand recognition.

Where We Are

Ladder is headquartered in New York City with a regional office in Miami, Florida.

All data presented above is as of September 30, 2025. Ladder is an investment grade-rated company, rated Baa3 by Moody’s Ratings and BBB- by Fitch Ratings, both with stable outlooks.

$25-$30 Million

Average Loan Size

Originated Loans in Over 475 Cities Across 48 States

$17.4 Billion

of Total Loans Securitized or Sold

Top CMBS

Loan Contributor

$4.7 Billion

in Total Assets

Transforming distribution and marketing with key capabilities in customer insight and analytics, omni-chan

Transforming distribution and marketing with key capabilities in customer insight and analytics, omni-chan

Transforming distribution and marketing with key capabilities in customer insight and analytics, omni-chan

A wonderful serenity has taken possession of my entire soul, like these sweet mornings of spring which I enjoy with my whole heart. I am alone, and feel the charm of existence in this spot, which was created for the bliss of souls like mine. More than 25 years of experience working in the industry has enabled us to build our services and solutions in strategy, consulting, digital.

A wonderful serenity has taken possession of my entire soul, like these sweet mornings of spring which I enjoy with my whole heart. I am alone, and feel the charm of existence in this spot, which was created for the bliss of souls like mine. More than 25 years of experience working in the industry has enabled us to build our services and solutions in strategy.

Far far away, behind the word mountains, far from the countries Vokalia and Consonantia, there live the blind texts. Separated they live in Bookmarksgrove right at the coast of the Semantics, a large language ocean. A small river named Duden flows by their place and supplies it with the necessary.

One morning, when Gregor Samsa woke from troubled dreams, he found himself transformed in his bed into a horrible vermin. He lay on his armour-like back, and if he lifted his head a little he could see his brown belly, slightly domed and divided by arches into stiff sections. The bedding.